Remote Inventory Reconciliation Services for International Clients

At ALGEBRAA, we specialize in providing remote inventory reconciliation services to businesses across the globe. Maintaining accurate inventory records is critical to controlling costs, preventing stock discrepancies, and ensuring smooth operations—especially in sectors like eCommerce, retail, manufacturing, distribution, and logistics.

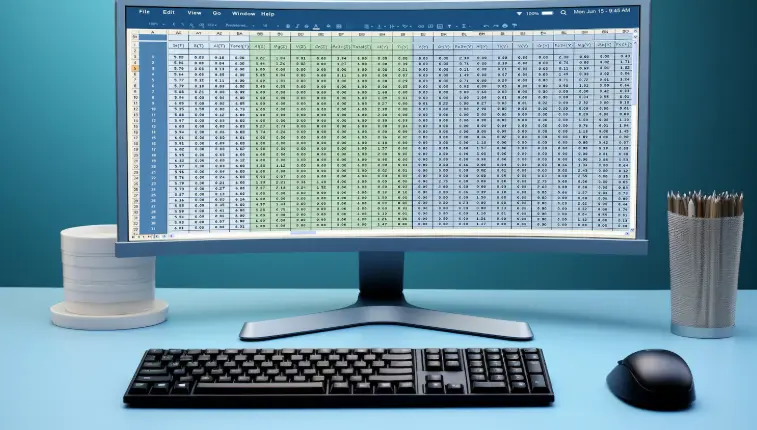

We support reconciliation in any Accounting or ERP software, including QuickBooks, SAP, Oracle, NetSuite, Microsoft Dynamics, Zoho, Tally, and more.

What Is Inventory Reconciliation?

Inventory reconciliation is the process of comparing your physical inventory count to the recorded quantities in your accounting or ERP system. Discrepancies can arise due to theft, damage, miscounting, data entry errors, or system issues. Regular reconciliation ensures your records reflect actual inventory levels, supports informed purchasing decisions, and enhances financial accuracy.

Our

Remote Inventory Reconciliation Services Include

Physical vs System Inventory Matching

- Compare physical stock counts to system-reported balances

- Identify variances, shortages, or overages

- Update ledgers and item master records accordingly

Stock

Movement Reconciliation

- Match incoming and outgoing stock with purchase/sales records

- Validate transfers, returns, and adjustments

- Track inventory by SKU, batch, location, or warehouse

Cycle Count Reconciliation

- Assist in periodic or rolling cycle counts

- Reconcile specific product categories or high-value items

- Analyze inventory turnover and highlight stale or excess stock

Inventory Valuation Checks

- Reconcile inventory value against accounting records

- Ensure valuation methods (FIFO, LIFO, weighted average) are correctly applied

-

Identify write-downs, obsolete stock, or

reclassifications

System

Configuration and Master Data Review

- Validate item master setup (UOM, categories, costs)

- Identify and clean up duplicate, inactive, or inconsistent records

- Configure or audit inventory modules in ERP systems

ERP and Software We Work With

- Accounting Platforms: QuickBooks, Xero, Zoho Books, Sage

- ERP Systems: SAP, Oracle NetSuite, Microsoft Dynamics, Tally, Odoo, ERPNext

- Inventory Tools: TradeGecko, Cin7, Unleashed, DEAR Systems, Fishbowl, and more

Our team adapts to your environment—whether you're running a legacy system or cloud-based platform.

Why Choose Our Inventory Reconciliation Service?

- Expertise Across Industries – Specialized in retail, eCommerce, manufacturing, and wholesale

- Data Security – Fully secure and confidential remote access protocols

- Actionable Insights – Identify theft, mismanagement, or valuation issues

- Flexible Engagements – One-time projects or ongoing support (daily, weekly, monthly)

- Dedicated Professionals – Work directly with experienced inventory accountants and ERP specialists

Let's Balance Your Inventory—Remotely and Reliably

Accurate

inventory is the foundation of profitability. Our remote inventory

reconciliation services ensure your records match reality—boosting financial

integrity, inventory control, and operational efficiency.

Frequently asked questions

Here are some common questions about our company and services.

A. General

Scope and Importance

Inventory Reconciliation is the process of matching the inventory value in your general ledger (GL) to the detailed records in your inventory sub-ledger and ensuring both align with the physical count. It is crucial for accurate COGS reporting, proper asset valuation (GAAP/IFRS), and detecting shrinkage or fraud.

We prevent losses by providing early detection of variance between system records and physical reality, identifying instances of shrinkage, obsolescence, or misposting that can severely impact profitability if left unchecked .

We reconcile all types: Raw Materials, Work-in-Progress (WIP), Finished Goods, and MRO (Maintenance, Repair, and Operating) supplies across manufacturing, retail, and distribution sectors .

Reconciliation is a continuous accounting process focused on data integrity and financial accuracy. Auditing is a periodic independent examination (often required externally) to express an opinion on the fairness of the inventory valuation.

We prepare reconciliation schedules compliant with both US GAAP (especially for LIFO) and IFRS (IAS 2), ensuring your inventory is measured at the lower of cost and net realizable value (NRV) .

We centralize the reconciliation process, managing multiple stock-keeping units (SKUs) and locations (warehouses, 3PLs, or consignment sites) across different time zones and currencies for a consolidated view.

We initiate a variance investigation to identify the root cause (e.g., incorrect receiving, misclassification unrecorded scrap, or theft) and prepare the necessary adjustment journal entry.

We primarily support perpetual inventory systems due to their reliance on continuous reconciliation, but we also support the large adjustment and COGS calculation required for periodic systems.

The most critical metric is Inventory Turnover Ratio and the percentage of Shrinkage/Variance between the physical count and the book balance.

By providing accurate, real-time data on stock levels and COGS, we enable more precise cash flow forecasts, purchasing decisions, and production planning.

Yes, we reconcile your inventory records against the stock reports provided by your 3PL partners, investigating any discrepancies to ensure your recorded asset value is accurate.

Yes. We track the terms (e.g., FOB Shipping Point vs. Destination) and ensure inventory in transit is recorded correctly on the books of the buyer or seller.

Shrinkage is the loss of inventory value due to theft, damage, obsolescence, or administrative errors. We calculate it by subtracting the physical count value from the book value and classifying the difference as a COGS expense .

While we do not perform physical duties, our reconciliation process is a critical check, ensuring that the person recording transactions is not the same person performing the physical count or authorizing adjustments.

We prepare the Inventory Rollforward Schedules, valuation support, and detailed adjustment work papers, significantly reducing the time your external auditors spend validating your inventory balance.

B.

Service

Frequencies and Deliverables

Daily service involves real-time monitoring of high-volume transactions (receipts, issues, transfers), processing cycle count results, and validating system interfaces to catch major variances before they compound.

Businesses in high-velocity sectors like e-commerce, food & beverage, or just-in-time (JIT) manufacturing where daily stock integrity is critical to operations and fulfillment.

A Weekly Variance and Exception Report, a summary of inventory movement (in/out), and reconciliation of the sub-ledger to the GL based on weekly closing numbers.

It allows for timely investigation of discrepancies and prompt corrective action, maintaining the accuracy of the perpetual inventory system and reducing month-end complexity.

Month-End Financial Close Support: Finalizing the valuation, calculating the COGS, preparing the Inventory Rollforward Schedule, and posting the final Shrinkage and NRV Adjustment entries.

The Monthly process ensures the Balance Sheet inventory asset is accurate and the Income Statement COGS is correctly stated, both required for standard monthly/quarterly financial reporting.

Quarterly service includes a deep-dive analysis of slow-moving inventory, recalculation of obsolescence reserves, and the preparation of all schedules required for a Quarterly financial review .

Companies that experience seasonal variations or those with less volatile inventory movements but still require periodic compliance checks for Quarterly reporting purposes.

Mid-Year Valuation Review and Policy Audit. We review costing methodologies, test the effectiveness of internal controls related to inventory, and perform a mid-year estimate of exposure .

Year-End Audit Readiness: Preparing the comprehensive Inventory Lead Schedule, final LIFO/NRV reserve calculations, and full documentation of the physical count process for auditors .

We manage the data reconciliation of cycle counts, comparing the counts to system records, calculating variance, and preparing the adjustment entries. The physical count is performed by the client's operations team.

We reconcile the materials issued to the production order against the standard BOM to identify material variance (waste or misuse) for WIP inventory.

Yes, we prepare the final, supported journal entry detailing the adjustment to the inventory asset and the corresponding expense account (Shrinkage, Scrap, or COGS .

We work on a strict deadline to ensure the final inventory balance and COGS figures are delivered to your tax preparer well in advance of the statutory deadline .

The WIP rollforward tracks costs moving into and out of WIP. The Finished Goods rollforward tracks the cost of inventory available for sale and the subsequent COGS expense.

We review goods received (GR) and goods shipped (GS) documentation around the month-end date to confirm the associated liabilities and revenue are recorded in the correct Monthly period.

Yes. We analyze inventory aging reports, flag items past shelf-life or those with no sales activity, and calculate the required obsolescence reserve on a Monthly basis .

You receive a comprehensive Inventory Work Paper Package including the final valuation report, NRV testing, audit rollforward schedules, and reconciliation to the GL.

We utilize a fully cloud-based, secure infrastructure. We have an IT support team that ensures 99.9% system uptime, backed by multiple layers of redundancy and daily data backups to prevent interruptions.

We reconcile the 'In-Transit' accounts, ensuring that inventory is properly tracked from the sending warehouse to the receiving warehouse and investigating any transfers that remain outstanding.

This is the final adjustment made at period-end to ensure the COGS accurately reflects the cost of the inventory sold, incorporating shrinkage and valuation reserves .

Yes. We reconcile your records with your consignee's reports, ensuring you only recognize revenue when the inventory is sold and not when it is shipped.

We categorize discrepancies (overs/unders) by location and SKU, investigating significant variances and preparing a summary report for management authorization before posting any adjustments.

Yes. We prepare the entries to remove the cost of damaged inventory from the asset account and charge it to a specific loss or expense account for clear visibility.

We maintain separate records for customer-owned goods and ensure they are never included in our inventory asset balance, only tracked as a memorandum item.

Yes. We prepare the inventory valuation data, including layers and indices, required for your CPA to perform the complex annual LIFO (Last-In, First-Out) calculation and reserve adjustment .

If theft is confirmed (e.g., through a security report), we prepare an immediate adjustment to expense the loss, often posting it to a separate non-COGS loss account.

Yes. We track the issuance of materials from inventory specifically for R&D and ensure these costs are correctly expensed, rather than remaining in the inventory asset balance.

We rely on batch processing once systems return online, prioritizing the immediate reconciliation of the missed transactions and verifying data completeness before starting the next day's work .

Yes. We provide an Inventory Aging Report on a Monthly basis, detailing how long stock has been held, which is crucial for identifying potential obsolescence.

C. Valuation,

Costing, and Compliance

We track the cost of goods received and issued, recalculating the WAC after every batch receipt and ensuring this rate is applied consistently to all withdrawals and COGS calculations.

We maintain detailed tracking of inventory layers (batches/lots) and ensure that the cost of the oldest inventory layer is recognized as COGS first, adhering to the FIFO assumption.

Inventory Cost is the purchase price. Landed Cost is the full cost of acquiring the inventory, including the purchase price plus freight, duties, customs, insurance, and handling fees.

We reconcile the vendor invoices with shipping and duty bills, calculating the appropriate allocation key (e.g., by weight, value, or volume) to assign a portion of the landed cost to each item.

NRV is the estimated selling price less the estimated costs of completion and disposal. We compare the cost to the NRV on a Quarterly basis, creating a reserve if the cost exceeds the NRV (as required by IFRS/GAAP).

Yes. We reconcile the Standard Cost to the Actual Cost and calculate the resulting material, labor, and overhead variances, preparing the entries to adjust the inventory and COGS back to actuals .

We work with your production data to calculate the allocation of fixed and variable manufacturing overhead (e.g., utility, indirect labor) and ensure the appropriate portion is capitalized into WIP and Finished Goods .

We run a Quarterly valuation test that compares the recorded cost of each SKU to its estimated NRV and prepare an adjustment to write down the inventory asset if the NRV is lower .

We track inventory on consignment and only transfer its value to COGS when the consignee notifies us of a sale, ensuring compliance with revenue recognition rules .

Yes. We track manufacturing costs (labor, materials, overhead) incurred in foreign currencies, performing the necessary currency conversions to report the final asset value in your base currency.

The cost flow assumption (FIFO, LIFO, WAC) dictates how costs are assigned to COGS and ending inventory. Consistency is mandated by GAAP/IFRS for comparability and proper financial reporting.

We audit the underlying assumptions (e.g., expected future sales, disposal costs) used to calculate the reserve, testing their reasonableness and preparing the required documentation.

We ensure the book cost aligns with the tax cost and prepare the necessary schedules for tax adjustments (e.g., reconciling LIFO reserve for US tax filing).

We immediately adjust the value of the affected finished goods and WIP to reflect the required write-down or reserve based on management's decision regarding rework or scrapping.

Yes, we provide the detailed cost and quantity reports required to substantiate the full inventory loss amount for insurance claims (e.g., due to fire or natural disaster.

C.

Technology,

Integration, and Data Control

We integrate with all major ERPs and WMS systems, including SAP, Oracle, NetSuite, Microsoft Dynamics 365, QuickBooks Enterprise, and specialized WMS platforms.

We use secure, read-only connections or scheduled data exports (CSV, flat files) from your system into our secured data processing environment, ensuring data integrity and confidentiality.

We analyze bin-level reporting to ensure the sum of all locations matches the total inventory sub-ledger balance, identifying any items physically located in the wrong spot.

Yes. We reconcile transaction logs generated by barcode/RFID scans against the system records to verify the accuracy of movements and reduce manual entry errors.

We use checksum validation and control totals during every data transfer to ensure that the number of records and total dollar value remains unchanged from extraction to processing.

Yes. During implementation, we perform parallel reconciliations to ensure the new system's COGS and inventory valuation calculations match the prior system's results before go-live.

A Dead Stock report lists inventory items that have had no movement (sales or usage) for a specified period (e.g., 90, 180, 365 days). We provide this Monthly or Quarterly.

We identify transactions where the UoM conversion factor was incorrectly applied (e.g., receiving in kilograms but selling in pounds) and prepare the correction entries.

Yes. We create a detailed, searchable audit trail that links the final GL inventory balance back to specific transactions (receipts, sales, adjustments) in the sub-ledger.

We analyze your current ERP settings and recommend best practice changes, particularly regarding costing methodology, lot tracking, and perpetual vs. periodic inventory settings.

We use role-based, least-privilege access, multi-factor authentication, and operate under ISO-certified data security standards.

We track inventory movements into and out of non-usable status (e.g., Quality Control, Quarantine) to ensure these assets are excluded from immediate sale and potentially reclassified for NRV testing .

Yes. We track the issuance of samples and ensure they are expensed immediately (not held as an asset) and charged to the appropriate marketing or promotional expense account.

Integration allows us to match vendor invoices to the correct received quantities and costs, ensuring accurate liability recording and landed cost calculation.

We perform a formal reconciliation between the WMS quantities (physical and system) and the ERP/GL quantities and values, resolving differences before the Monthly close.

D.

Global

Compliance and Audit Support

Yes. We prepare the detailed, highly structured work papers and control documentation required for audits of public companies in the US, adhering to the stringent PCAOB standards.

We prepare the financial data under IFRS or local GAAP (e.g., UK FRS 102), ensuring all disclosures regarding valuation methods and reserves are properly documented for local regulators.

Yes. We track duties, tariffs, and customs fees for imports across target markets (USA, UK, EU, etc.) and ensure these are correctly capitalized as part of the inventory's Landed Cost.

By performing continuous (Daily/Weekly) reconciliation, we proactively identify and correct errors (e.g., incorrect COGS, missed cutoffs) before the auditor begins fieldwork .

We provide the auditor with the Count Sheet Summary, reconciliation of the count to the system, and the authorized adjustment entry confirming the physical count date cutoff was observed.

We track the spot rate at the time of purchase and ensure inventory is valued correctly. We then calculate and track any subsequent foreign exchange gains or losses on payment of the liability.

Yes. We track the cost of goods sold between related entities, providing the detailed cost data and margin analysis required for your tax advisor to set arm's-length transfer prices.

We provide accurate, verified reports on the quantity and value of the collateral inventory, fulfilling the reporting requirements of your secured lenders.

We enforce a single, standardized Group Inventory Policy (e.g., FIFO, NRV testing frequency) across all entities and reconcile their data to this central policy.

Yes, we provide the COGS data and historical defect rates required for your finance team to accurately calculate the warranty liability (a component of the NRV calculation.

E.

Advisory

and Internal Control

1)

Proper Segregation of Duties (physical handling vs. record keeping).

2)

Formal Cycle Count program.

3) Formal NRV/Obsolescence review and

authorization process

.

Yes. We draft a formal policy manual detailing your chosen cost flow assumption, capitalization rules, and valuation procedures, ensuring GAAP/IFRS compliance.

We recommend requiring weekly/monthly reports from consignees, periodic physical verification, and clear contractual terms that define ownership transfer.

While we are not security experts, our reports can highlight locations or departments with excessive, unexplained shrinkage, guiding management to focus their security efforts.

We ensure that the cost of these materials is removed from inventory and capitalized into the appropriate Fixed Asset account rather than being charged to COGS.

We recommend that management review the Weekly variance reports and the Monthly NRV and shrinkage reports to ensure timely operational decisions are made.

Yes. We assist in setting a threshold (e.g., 0.5% of total inventory value) below which adjustments are automatically posted, but above which requires management review.

We provide the financial data (cost, NRV, rework cost estimate) to assist management in making the most financially advantageous decision .

We rely on external manual transaction logs (or warehouse system logs) during downtime and perform an immediate reconciliation once the main system is back online to verify all transactions posted correctly .

Manual Data Entry Errors at the receiving or shipping point, leading to inaccurate quantity and cost records in the perpetual system.

F.

Miscellaneous

Pricing is based on a transparent model that considers 1) the complexity of the costing method (FIFO vs. Standard), 2) the number of SKUs and warehouses, and 3) the required service frequency (Daily, Monthly, etc.).

Our SLA guarantees a specific turnaround time for the Monthly close reconciliation and a maximum variance tolerance rate for the reconciliation process.

Yes. Our model is flexible, allowing you to scale up to Daily/Weekly during peak production cycles and revert to a standard schedule during slower periods.

We start with a System and Process Assessment, where we review your current ERP setup, COGS methodology, and documentation to tailor our reconciliation rules.

Yes. You will be assigned a dedicated specialist who understands your business, costing methods, and system integrations, ensuring consistent and high-quality service.